On January 8, the China Tourism Academy (Data Center of the Ministry of Culture and Tourism) released the "2018 Tourism Economic Operation Review Series Report: Tourism Industry". The report shows that throughout 2018, the tourism industry was relatively prosperous, and the integration of culture and tourism has strongly promoted industrial investment. Further attention needs to be paid to the balanced development of the market and industry, macro and micro, and investment and benefits.

1. Operation status of tourism industry in 2018

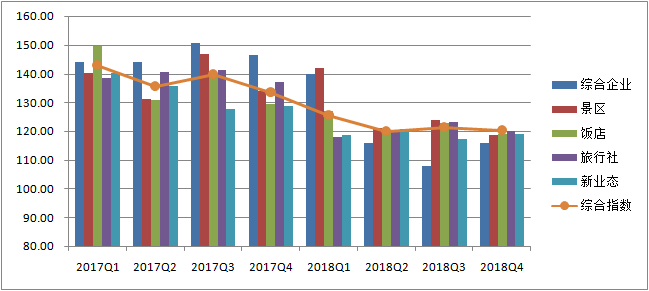

The industry is relatively prosperous. In 2018, affected by the unfavorable expectations of entrepreneur confidence, product prices, operating income, operating costs, etc., the tourism industry prosperity index in each quarter was 125.5, 120.0, 121.4 and 120.35 respectively, down from the same period last year, but still operating in the "relatively prosperous" range. From the perspective of the prosperity index of different industries, tourist attractions, tourist accommodation and new tourism formats are significantly better than tourism groups and traditional travel agencies. From the perspective of industrial factors and development momentum, the number of employees and fixed asset investment still maintains a growth trend.

Figure 1 2017Q1-2018 National Tourism Industry Prosperity Index

Industrial innovation is more active. The demand for quality tourism consumption drives corporate product development and business innovation. Pure play without shopping, high-end hotels, exclusive tour guides, exquisite small groups, and customized tours have become the keywords for domestic travel in 2018. Urban leisure tourism is rising rapidly. Big data companies represented by Meituan and Dianping have driven the upgrading of traditional industries by serving local residents' leisure and entertainment. Investment and mergers and acquisitions related to the integration of culture and tourism have increased. Business technologies such as big data, cloud computing, and artificial intelligence have transformed more leisure resources of urban and rural residents into cultural and tourism products that are popular with the masses.

II. Development of tourism industry by category

1. Tourist attractions: providing new content for quality tourism

The transformation and upgrading of tourist attractions accelerated in 2018. Scenic spots attach equal importance to sightseeing and leisure vacations, traditional and new formats are rising together, and tourism companies are gradually cultivating niche markets. Only by improving the quality of services through technological progress can the expansion of the market space of the scenic spot industry be guaranteed.

The demand for a better life promotes the improvement of the quality of scenic spots. The national tourism demand has shifted from beautiful scenery to a better life, and the decline in the proportion of sightseeing tours has become a medium- and long-term trend in the national tourism market. Tourists need Disney and Universal Studios, high-level scenic spots represented by world natural and cultural heritage, as well as Gubei Water Town, Happy Valley, Fantawild, Chimelong Safari Park, Haichang Ocean Park and other urban recreational spaces, as well as Blue Harbor, Tianzifang, Lingnan No. 5, Zhengjia Plaza and other urban leisure scenes. National tourist resorts, tourism and leisure demonstration cities, national ecotourism demonstration areas, cruise tourism development experimental areas, and self-driving RV camps are opportunities for development.

The theme park layout has spread to second- and third-tier cities. The layout of theme parks continues to sink, expanding to second- and third-tier cities. The expansion model has changed from heavy to light. Songcheng, Huaqiang Fantawild, Haichang Ocean Park, OCT, etc. have all entered emerging markets with light asset models. International theme parks continue to enter, and local forces continue to grow. According to calculations by the China Tourism Academy, there are about 2,100 theme parks in China, and about 300 have investments of more than 50 million yuan. Among the more than 10,000 A-level scenic spots, 339 (3.92%) are theme entertainment scenic spots. The development of local theme parks places too much emphasis on scale and lacks innovation in new culture. They have been deployed in second- and third-tier cities.

The trend of tourism performance concentration remains unabated. The Yangtze River Delta, the Pearl River Delta and the southwest region have become industrial agglomeration areas. The growth of tourism performance income in first-tier tourist destinations such as Sanya and Lijiang has slowed down, and the high-quality scenic spots in second- and third-tier tourist cities have become investment targets. In terms of investment amount, product level, and market popularity, the "Impression" series, "Landscape Festival" series, and "Eternal Love" series rank in the top three. The three major performing arts companies are trying to go international, and the operating model is mainly self-built. Tourism performances show a trend of "high investment, high technology, large production, and production by famous directors."

Characteristic towns are entering a period of transformation and development. With the support of policy dividends, the construction of characteristic towns has become a new driving force for economic development. However, some places have blindly followed the trend and tried to simply copy the experience of other places or foreign countries. There are certain risks. The development of characteristic towns has entered a period of transition from quantity to quality. Future development requires that all places should scientifically distinguish their own basic conditions and concepts in promoting the development model of characteristic towns, and develop characteristic towns according to local conditions.

2. Travel services: Intensified two-way competition based on the supply chain

The service capabilities of the travel service industry continue to improve. In 2018, the channel sinking of online service providers and the network operation of traditional travel agencies are still accelerating. The integration of online and offline development has improved the connection efficiency between online traffic acquisition and offline conversion. Large online travel agencies have targeted offline store layouts to improve offline customer acquisition capabilities. According to Ctrip's second quarter financial report in 2018, its brand penetration rate in low-tier cities increased by about 40% year-on-year. Traditional travel agencies are accelerating the construction of networks to retain customers with better services.

The two-way game based on the supply chain is intensifying. The tentacles of upstream travel service providers continue to extend downwards, trying to connect directly with consumer terminals. With the increase in direct air tickets and the reduction in agency fees, and airlines stopping third-party services, the retail trend of upstream suppliers is becoming increasingly obvious. Travel service providers are expanding upwards to enhance their control over the resource end. Ctrip, Spring Airlines, Tuniu, Tongcheng and others have reached cooperation with airlines. Alibaba Group and Marriott International Group have fully opened up their membership systems and jointly operated online platforms through joint ventures. Some travel service providers have also intervened in the investment and operation management of scenic spots and hotels. The two-way penetration of suppliers and service providers is a typical phenomenon in the current industrial development.

Achieve diversified supply through cross-border integration. Travel service providers have shifted from a single form dominated by traditional travel agencies to an innovative integrated development market entity with multiple formats and multiple entities. Leading companies represented by Ctrip have begun to focus on the continuous building of their core competitiveness, rationally utilizing technology, capital, data assets and other factors to innovate services, processes and integrate resources, enhance control over resources and customer acquisition capabilities on the demand side, achieve standardized and refined operations on the backend of the company, and provide differentiated services with quality and warmth on the front end.

Customized travel business moves from high-end to the masses. Customized travel is gradually maturing, and users’ needs are complex and scattered. Travel service providers’ ability to integrate fragmented resources needs to be improved, especially for information management of non-standard products. Customization business faces the problem of balancing service and efficiency between man and machine, which tests the enterprise's IT capabilities. In the process of going to the masses, it is necessary to improve the ability of mass customization and reduce costs to increase the profit margin of the overall operation. Based on big data technology, travel service providers can achieve accurate user portraits and precise matching of products.

3. Tourism accommodation industry: entering the stage of stock game and differentiated competition

The accommodation industry is huge in scale, but its growth rate has begun to slow down. There is still much room for improvement in profitability and service quality. There are imbalances in regional, grade and product structure. These problems objectively force the accommodation industry to change its development model and embark on the path of high-quality development.

The growth rate slowed down after the high growth in scale. The fixed asset investment in the accommodation industry has increased by more than 10 times for many years. After a long period of rapid growth, the growth rate began to slow down in 2014 and fell for the first time in 2016. In the future, the scale of the accommodation industry will have a large room for growth, but the high-speed growth stage has undergone qualitative changes. The industry's focus on the accommodation industry is shifting from development scale and speed to quality and performance. The accommodation industry has shifted from high-speed growth to high-quality development.

Small profits force quality development. Since hitting bottom in 2014, the performance of the accommodation industry has gradually recovered, but the overall profit margin is unlikely to exceed 3%. Even in 2017, the best year in recent years, the overall profit of 816 five-star hotels was only 6.56 billion yuan (8 million yuan per hotel on average), and the remaining more than 8,000 star-rated hotels only made a profit of 700 million yuan. The high capital cost of the hotel industry (more than 6%, or even more than 10%) forces high-quality development. In the long run, hotel investment helps to enhance the value of the investment portfolio and improve the image of the city. The rising trend of hotel yields in the United States may indicate that the low return rate of Chinese hotels is not normal, and may return to a high level of investment return in the future.

The growth of hotel group scale is out of step with the improvement of brand influence. In July 2018, the hotel industry magazine "HOTELS" announced the ranking of global hotel groups based on guest room size and number of hotels. Jin Jiang, BTG Homeinns and Huazhu continued to remain among the top ten in the industry. Among them, Jinjiang continues to rank fifth on the list with 680,111 guest rooms and 6,794 open stores; BTG Homeinn continues to rank eighth on the list with 384,743 guest rooms and 3,712 open stores; Huazhu continues to rank at the top with 379,675 rooms and 3,746 open stores. Ninth place, the ranking has further improved, but the brand influence is still limited. High-end brands have weak premium capabilities, while mid-range and economical brands have a high domestic share but no global influence.

The accommodation industry is moving towards a stage of high-quality development. At present, consumers' demands for accommodation experience and service quality are increasingly differentiated. Accommodation supply has structural imbalances such as urban and rural areas, population groups, business levels, and insufficient types and content. Filling the "quality gap" is the key to the high-quality development stage. The potential is there. Use big data to profile consumers, and focus on matching supply and demand with a people-oriented approach. Improving the industrial value chain and product added value and providing more efficient and warm public services will significantly enhance competitive advantages. The accommodation industry has begun to enter the stage of stock game and differentiated competition, and there is urgent pressure for change in all subdivisions of the industry.

4. Tourism Group: Actively practicing corporate social responsibility

Mergers and acquisitions are frequent, and the competition landscape is optimized. In 2018, tourism groups accelerated their integration, investment and mergers accelerated, and a pattern of giants emerged. Jinjiang International acquired Radisson Hotel Group and became the world's second largest hotel group; OCT strategically invested in Tongcheng Travel to strengthen its control over online traffic. Meituan Dianping acquired Mobike, Tujia acquired Dayu Self-Guided Tours, Tengbang International strategically invested in Xiyou International Travel and participated in the investment in Octopus, and Alibaba acquired Ele.me. Competition in the online service field has become more intense. Meituan Dianping, Tongcheng Elong, and Fosun Tourism Group have successively gone public, striving to expand their market share.

Brand innovation is accelerating and competitiveness continues to improve. Creativity and innovation are becoming the magic weapon for the group to improve its competitiveness. The accommodation industry has created hotel brands with different cultural connotations. Puyin and Shibai Cloud under BTG Hotels, Meitu, Senbo, Atik, Atour and Muji Hotels under Kaiyuan Hotel all combine art, Social life, lifestyle and hotel functions are combined. Travel agencies use culture to build competition barriers. Shanghai Spring and Autumn Tourism integrates cheongsam and Tai Chi culture into product innovation, and Jingyu Group launches a unique IP series to build core competitiveness.

Promote the integration of culture and tourism and enhance development momentum. Taking the reform of national and local cultural and tourism institutions as an opportunity, cultural tourism enterprises accelerate the tourism development of cultural resources and the commercial transformation of cultural creativity. In 2018, ten publishing groups including Reader Publishing Group established the National Publishing and Distribution Industry Cultural Tourism Alliance, which plans to promote the deep integration of cultural education and tourism industries through the industrial cooperation model of "culture + education + tourism". Reader Publishing Group and Liaoning Publishing Group use study tours as "touch" tourism development and become new suppliers of the tourism industry. CYTS Wuzhen and Gubei Water Town use cultural elements as the entry point to optimize product and service supply. Huaqiang Fantawild creates original IP and explores historical IP to build the competitiveness of enterprise development. Shaanxi Tourism Group created "Song of Everlasting Sorrow" to meet tourists' diverse needs for culture and entertainment, and drive the development of Huaqing Pool Scenic Area and surrounding accommodation, catering and other enterprises.

Respond to national strategies and proactively fulfill social responsibilities. The tourism group actively serves national strategies such as the “One Belt and One Road” initiative, Northeast revitalization, industrial poverty alleviation, western development, and rural revitalization. Represented by China Tourism Group, Jinjiang International Group, Kaiyuan Tourism Group, Ctrip, HNA, etc., they continue to expand the brand influence and influence of Chinese enterprises in the international market through various forms such as exporting brands and management models and acquiring overseas tourism brands. International Competitiveness. Tourism group companies also pay close attention to social responsibility issues. Ctrip has launched a global 24-hour "Travel SOS" service to provide tourists with free emergency assistance during travel. Wanda Group pioneered the tourism "Poverty Alleviation in Counties" model in Danzhai County, Guizhou, China Tourism Group's "Tourism Industry Poverty Alleviation" model in Guizhou and Yunnan Province, and Ctrip Group's "Online Marketing Poverty Alleviation" model, etc., have all achieved good results.

3. Outlook for the development of the tourism industry in 2019

1. Tourist attractions

For the development of scenic spot enterprises in 2019, first, they will gradually get rid of single ticket revenue. The scenic spot responds to the top-level system design and uses IP to develop derivatives and non-ticket business income to improve the operating efficiency of the scenic spot. The proportion of ticket expenditure in tourism consumption expenditure will gradually decrease. Second, the growth of online tickets has slowed down, and scenic spots have become an important traffic port for OTAs. Scenic spots and destinations are gradually getting rid of their dependence on the ticket economy and beginning to transform into an industrial economy. OTAs are expected to increase cooperation with scenic spots and accelerate technological innovation. Third, technology will give birth to a new generation of virtual scenic spots. VR and AR technologies will become the basic configuration of tourist attractions, shopping malls, museums, and theme parks. The virtual scenic spot platform will be a shared tourism VR and AR real-life experience scene database.

2. Travel services

In 2019, the development of the travel service industry will be led by service innovation and content creation. Competition in non-standard tourism products with content creation as the core will become another competitive factor in addition to service quality. Tourists' demand for high-quality services will further increase, and some niche travel platforms that emphasize culture and knowledge will begin to emerge. Second, external precision marketing and internal refined operation capabilities will become inevitable. The improvement of the informatization of the back-end supply chain and front-end channel management, the realization of back-end refined management, and the reduction of customer acquisition costs to effectively improve the efficiency of the travel service industry will become a breakthrough in performance improvement.

3. Tourism accommodation industry

For the development of the tourism accommodation industry in 2019, firstly, the development momentum has shifted from factor-driven to innovation-driven. In particular, the application of artificial intelligence, virtual reality/augmented reality, Internet of Things, big data, modular construction technology and big health technology in the accommodation industry can give rise to new business models and promote industrial efficiency improvements. The importance of cultural creativity and IP to accommodation formats such as boutique hotels, theme hotels, and boutique B&Bs will become even more prominent. Second, consumption upgrading leads to industrial upgrading. Low-end and high-end consumption in tourism accommodation have always coexisted, but overall consumption continues to upgrade and the structure begins to differentiate. The middle class is a group that needs attention. Millennials have become the main force of consumption. We should pay attention to the upgrading of the accommodation industry chain and the reconstruction of the value chain, and cultivate unicorns and hidden champions in the accommodation field. Third, disruptive innovation should focus on breaking through boundaries and focusing on edges. Focusing on the core, deepening the core, and professional development are still the fundamental ways for the development of the accommodation industry, but many innovations come from expanding boundaries and integrating development. The power of the long tail is very powerful, and once integrated through network technology, it can have a disruptive effect.

4. Tourism Group

First, industrial integration will continue to empower tourism groups. Tourism groups should be people-centered, adhere to the reality of cultural and tourism products needed by the people, and make valuable cultural and tourism products advocated by national strategies. Industrial integration will provide new directions for the business expansion of tourism groups. Health tourism, study tourism, sports tourism, event tourism, low-altitude tourism, and museum tourism are expected to become new areas for tourism groups to accelerate their expansion. Second, the expansion of life functions will become a new direction for the development of tourism groups. The provision of life services for tourists in destination cities and local life services for local residents is becoming a new area for the expansion of tourism groups' business. Third, innovation is still an important driving force for the sustainable development of tourism groups. Targeting new consumer groups such as the post-80s/90s young people and the middle class, we will combine technological innovation with demand resolution to provide tourists with new products and services that are more convenient, higher quality, and more experiences.

Original manuscript: Yang Honghao, Zhan Dongmei, Wu Liyun, Zhang Yang, He Qiongfeng

Edited by: Tang Xiaoyun

Produced by: He Qiongfeng, Zhang Jiayi

Source: China Tourism Academy (Data Center of the Ministry of Culture and Tourism)

If reproduced, please indicate source