On March 26, our institute hosted the "Annual Landmark Achievements Release Conference of China Tourism Academy", and released a total of 8 landmark research results. Dr. Liu Xiangyan from the Institute of International Studies (Institute of Hong Kong, Macao and Taiwan) of our institute released the "Annual Report on the Development of China's Inbound Tourism 2024" on behalf of the research team.

With the continuous release of the dividends of inbound tourism visa, payment, accommodation and other facilitation policies, after the substantial growth of my country's inbound tourism market in 2023, it will show a more obvious recovery and growth trend in 2024, and will fully recover from the impact of the epidemic this year. The development of inbound tourism has become an important carrier to demonstrate my country's high level of opening up to the outside world. In the coming period, my country will continue to improve the convenience of traveling to and in China, establish and improve the overseas tourism publicity and promotion system, and regularly disclose inbound tourism statistics and market survey results to provide data support for decision-making by destinations and market players.

1. The inbound tourism market is recovering faster

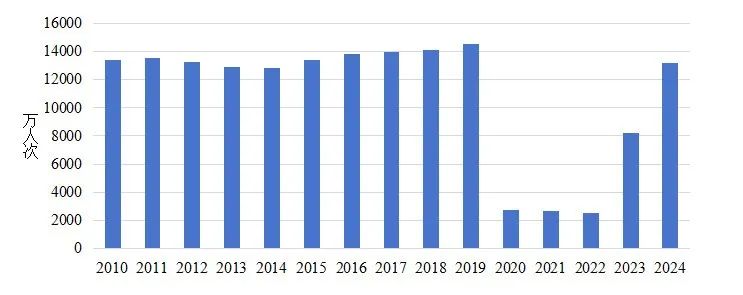

In 2024, the pace of recovery and growth of my country's inbound tourism market will further accelerate. Unlike the three-quarter recovery period in 2023, the entire year of 2024 will be a recovery period for the inbound tourism market, and the recovery momentum will be more significant. According to the latest Statistical Bulletin on National Economic and Social Development, in 2024, my country will receive a total of 131.9 million inbound tourists, a year-on-year increase of 61%, recovering to more than 90% of the level in 2019, far higher than the recovery level in 2023.

Figure 1: my country's inbound tourist reception from 2010 to 2024 Data source: China Tourism Academy, Statistical Communiqué on National Economic and Social Development

The rapid recovery of the inbound tourism market is inseparable from a series of promotion policies, including visa, payment and accommodation facilitation. In particular, in terms of visas, starting from the second half of 2023, my country has adopted an unprecedented entry visa facilitation policy, and has orderly expanded the scope of unilateral visa-free countries in December 2023, mid-March 2024, late June, late September, early November and late November. By the end of 2024, my country has implemented a unilateral visa-free entry policy for 38 countries. Together with the 25 countries that have fully exempted visas with my country (China and Uzbekistan signed a visa exemption agreement on December 1, 2024, but it has not yet come into effect), this means that citizens of 63 countries can come to China visa-free with ordinary passports. In addition, my country has comprehensively relaxed and optimized the transit visa-free policy, and implemented different degrees of visa-free policies for cruise group tourists and foreign group tourists from Hong Kong, Macao and Taiwan. The visa-free policy has a significant effect on inbound tourism. The Statistical Bulletin of National Economic and Social Development in 2024 shows that 20.12 million foreigners entered China through visa-free entry, an increase of 112.3%. Based on the data of foreigners' entry and exit checked by the border inspection agencies of the Immigration Bureau, the research team estimates that more than 60% of foreigners came to China through visa-free entry.

Our survey based on the sample companies in the inbound tourism case database also shows that compared with 2023, the number of tourists received by inbound travel agents in 2024 has generally rebounded. For a small number of inbound travel agents serving high-end customized users or specific markets such as MICE, their number of tourists received has recovered to or even exceeded the level of 2019; the recovery level of travel service providers that mainly provide fragmented products and professional theme line products is also relatively high, and many have recovered to 60% to 70% of the number of tourists received in 2019. Relatively speaking, the recovery level of traditional package inbound travel agencies is lower, and some respondents said that their business has recovered to about 50% to 60% of 2019.

II. Uneven recovery of inbound tourism source markets

1. The inbound tourism market in Hong Kong, Macao and Taiwan has a solid foundation. According to the latest national economic and social development statistical bulletin, in 2024, residents of Hong Kong, Macao and Taiwan will visit the mainland/mainland 104.96 million times, a year-on-year increase of 54%, accounting for about 80% of the overall inbound tourism market. Hong Kong, Macao and Taiwan remain the primary inbound tourism market. As the "cross-city consumption" boom in the Guangdong-Hong Kong-Macao Greater Bay Area continues to heat up, Hong Kong people's enthusiasm for going north continues to rise. Data from the Shenzhen Border Inspection Station shows that in 2024, more than 77 million Hong Kong residents will enter the mainland through various ports in Shenzhen. Data from the Statistics and Census Bureau of the Macao Special Administrative Region shows that in 2024, 583,000 Macao residents will purchase outbound tourism services through travel agencies, of which 77% will go to mainland China. Similarly, the mainland continues to be one of the most important outbound tourism destinations for residents of Taiwan. According to statistics from the tourism department of Taiwan, mainland China is the second largest outbound tourism destination for Taiwan residents, and 2.77 million Taiwan tourists will visit mainland China as their first stop in 2024.

2. The structure of the inbound tourism market for foreigners has been differentiated, and the pace of recovery of the inbound tourism market for foreigners has accelerated. According to the latest Statistical Bulletin on National Economic and Social Development, my country will receive 26.94 million foreign tourists in 2024, a year-on-year increase of 96%, significantly higher than the growth rate of the inbound tourism market in Hong Kong, Macao and Taiwan.

Some Southeast Asian markets may have returned to pre-pandemic levels. The visa-free policy has a significant effect on short-distance markets such as Singapore, Malaysia and Thailand, which are the fastest recovering foreign source markets. In 2024, Southeast Asian source markets such as Singapore, Malaysia and Thailand are likely to have returned to pre-pandemic levels. Many travel agencies said that they received more Southeast Asian tourists last year. With more frequent trips from Southeast Asia to China, Southeast Asian tourists have higher requirements for the depth of their experience in China, and the mid- to high-end market in Southeast Asia has great potential.

The recovery of the Japanese and Korean markets is relatively slow. Compared with Southeast Asian markets such as Singapore, Malaysia and Thailand, Japan and South Korea, which are also short-distance markets, have recovered relatively slowly. In 2019, the number of tourists from South Korea and Japan to China was 4.35 million and 2.68 million respectively. According to the data of the National Immigration Administration, from January to August 2024, the number of Korean and Japanese citizens entering China was 1.59 million and 680,000 respectively, which is a big gap compared with 2019. With my country's trial of unilateral visa exemption for South Korea and Japan in November last year, it is expected that the tourism market from the two countries to China will accelerate its recovery this year. Among them, unlike the Japanese market, which has been affected by currency depreciation, it is expected that the Korean tourism market to China is expected to recover faster.

The European and American markets also recovered slowly. Affected by geopolitical issues such as the Russian-Ukrainian conflict and trade frictions, direct flights from Western Europe and North America to China have recovered slowly. Inbound travel agents engaged in receiving European and American tourists generally said that European and American tourism to China will recover relatively slowly in 2023 and 2024. They said that the recovery of the US and British markets was poor, even less than 30% of that in 2019. In contrast, the business recovery of the Spanish and Italian markets, which had a smaller market base before the epidemic, was relatively fast.

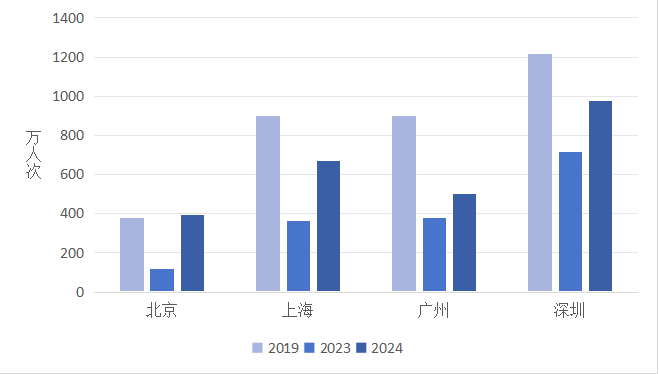

Emerging source markets have development potential. Many travel agencies that provide customized and themed route products said that they received many inbound tourists from emerging source markets in 2024. These source markets include Hungary, Bulgaria, Poland and other countries in Central and Eastern Europe, Spanish-speaking countries such as Mexico and Latin America, and Russian-speaking countries in Central Asia. In the future, these travel agencies are expected to receive more tourists from the above-mentioned emerging markets and intend to further expand their business in these markets in the future. III. The pace of recovery of inbound tourism in major urban destinations varies 1. Beijing, Shanghai, Guangzhou and Shenzhen continue to be the most important entry port cities. The scale and recovery level of inbound tourism reception in Beijing, Shanghai, Guangzhou and Shenzhen are relatively high. According to the public statistics of each city, in 2024, the number of inbound tourists received by these four cities will be close to or exceed 4 million. Among them, Shenzhen and Shanghai have the highest number of inbound tourists, receiving 9.77 million (overnight) and 6.71 million inbound tourists respectively. Shenzhen mainly benefits from the large number of visits from Hong Kong and Macao residents, especially Hong Kong residents, accounting for 85% of the total number of inbound tourists, and the total number of visits from Hong Kong and Macao residents accounts for as high as 97%. In terms of the level of recovery, the number of inbound tourists received by Shenzhen and Shanghai has recovered to more than 80% of that in 2019. Beijing and Shanghai received the highest number of foreign tourists, 3.21 million and 4.97 million respectively. They not only have a profound cultural heritage and modern urban style, perfect infrastructure and tourism reception facilities, but also have a strong international reputation and appeal. They are the preferred destination cities for foreign tourists to enter China.  Figure 2 The reception of inbound tourists in the four cities of Beijing, Shanghai, Guangzhou and Shenzhen in 2019, 2023 and 2024 Data source: Public tourism statistics of various cities Note: The data of Beijing in 2019 and 2023 are inbound overnight data; the data of Guangzhou and Shenzhen are inbound overnight data. 2. The recovery of inbound tourism in various cities is fast and slow. In addition to the four first-tier cities, the research team searched the top 25 cities in terms of inbound tourist reception in 2019, and collected relevant statistical data from 12 cities in total. The 12 cities include: Chongqing, Chengdu, Hangzhou, Xi'an, Kunming, Nanjing, Suzhou, Xiamen, Guilin, Zhangjiajie, Sanya and Zhuhai. Seven of them announced the data on inbound tourist reception for the whole year of 2024, three cities announced the data for the first three quarters of 2024, and two cities announced the data for the first half of 2024.

Figure 2 The reception of inbound tourists in the four cities of Beijing, Shanghai, Guangzhou and Shenzhen in 2019, 2023 and 2024 Data source: Public tourism statistics of various cities Note: The data of Beijing in 2019 and 2023 are inbound overnight data; the data of Guangzhou and Shenzhen are inbound overnight data. 2. The recovery of inbound tourism in various cities is fast and slow. In addition to the four first-tier cities, the research team searched the top 25 cities in terms of inbound tourist reception in 2019, and collected relevant statistical data from 12 cities in total. The 12 cities include: Chongqing, Chengdu, Hangzhou, Xi'an, Kunming, Nanjing, Suzhou, Xiamen, Guilin, Zhangjiajie, Sanya and Zhuhai. Seven of them announced the data on inbound tourist reception for the whole year of 2024, three cities announced the data for the first three quarters of 2024, and two cities announced the data for the first half of 2024.

Thanks to their proximity to Hong Kong, Macau and Taiwan, Xiamen and Zhuhai receive a high number of inbound tourists. In 2024, Xiamen and Zhuhai will both receive more than 2 million inbound overnight tourists. They mainly benefit from the large-scale visits of residents from Taiwan and Hong Kong and Macau, which are close to each other. Data from relevant city statistics departments show that the Taiwan market contributes 39% to Xiamen's inbound overnight tourism market, while the Hong Kong and Macau market contributes 84% to Zhuhai's.

Some cities with a smaller market base recovered faster. In 2024, the number of inbound tourists received by Zhangjiajie and Hangzhou exceeded the pre-epidemic level. The smaller market base has largely increased the recovery level. In 2019, the number of inbound tourists received by Zhangjiajie and Hangzhou was relatively low, at 1.37 million and 1.13 million respectively (overnight data). In contrast, cities with a higher market base in 2019, such as Chongqing, Chengdu, Xi'an, and Guilin, have a relatively low recovery level.

IV. The prospects for inbound tourism development remain optimistic

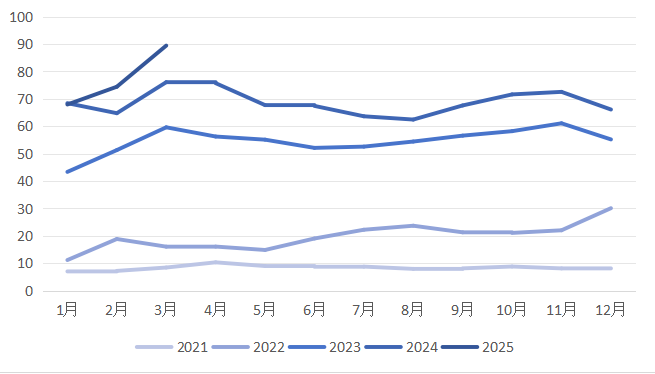

1. The inbound tourism market is about to fully recover from the impact of the epidemic, and the potential demand for tourism to China continues to increase. Google search data shows that in 2024, overseas people's searches for flights and accommodation to China continued to be higher than the same period last year, and on average 26% higher than the same period in 2023. In the first quarter of 2025, overseas people's searches for flights and accommodation to China continued to be higher than the same period last year. In the coming period, the potential demand for tourism to China will further increase.

Figure 3 Average daily search index of overseas people for flights and accommodation to China from 2021 to 2025 (January to March)

Data source: Travel Insights with Google

With the further release of benefits from convenient policies on inbound tourism visas, payment, accommodation, etc., various destinations continue to improve their reception facilities for inbound tourists and enhance service quality. In addition, with the country and local governments actively carrying out overseas marketing and promotion activities, my country's inbound tourism will fully recover from the impact of the epidemic by 2025.

2. Changes in demand and technological innovation drive the diversification of the industry ecosystem. The market trend of increasingly diversified inbound tourist demand is driving the diversification of tourism supply. On the one hand, the diversification of demand is attracting new market participants. Some travel agencies that originally focused on outbound tourism, such as Yuanhai International and Utour, have keenly captured the potential of the inbound tourism market with their rich industry experience and international resources, and have or are transforming into this field. On the other hand, traditional package travel service providers are actively adjusting their business strategies. They are tailoring exclusive travel itineraries based on the personalized preferences and needs of inbound tourists and expanding themed customized travel route products. At the same time, in order to adapt to the rise of the individual tourist market, some package travel service providers are also actively deploying fragmented products such as one-day tours and half-day tours, providing potential inbound tourists with more flexible and convenient product choices.

Technologies such as AI are deeply integrated into the travel service industry, and the inbound travel service industry may be facing profound changes that have not yet been fully perceived. This change will not only play an important role in improving industry efficiency and service quality, but will also promote market differentiation and reshape the existing industry landscape. Many increasingly mature travel planning AI tools have emerged internationally, such as Mindtrip, Layla (formerly Trip Planner AI), Wanderplan, etc., and vertical AI platforms dedicated to serving international tourists to China have also emerged in my country, such as GoChina.ai. In the future, as these tools are used by more inbound individual tourists, my country's attractions, accommodation, restaurants, retail and other tourism suppliers and C-end travel service providers will need to increase exposure on global online platforms, and enhance digital assets by accumulating positive user reviews to increase the chances of being recommended by AI.

In the long run, with the further application of AI technology and other digital tools, the trend of industry differentiation may become more obvious. AI technology will promote the current less standardized products, such as travel planning, instant explanations and guided tours, to gradually transform into standardized products, further eroding the business scope of traditional travel agents. In this scenario, the upgraded OTA platform or the new digital platform based on new technologies such as AI will focus more on the mass market and provide standardized tourism products; while traditional travel agents can continue to focus on providing quality travel services and irreplaceable experiences for mid- to high-end users by improving service quality and warm experience.

V. Multi-party collaboration to promote high-quality development of inbound tourism

Based on the analysis of the inbound tourism market and feedback from inbound travel agents, and combined with the experience and practices of neighboring countries, the research team put forward policy recommendations to promote the high-quality development of inbound tourism.

1. Continue to improve the convenience of visas to and travel in China and further optimize the existing visa facilitation policies. Timely extend the applicable period of the current unilateral visa-free policy. The unilateral visa-free policy of some countries will expire at the end of December 2025. Timely extension of the unilateral visa-free policy can send positive signals and expectations to potential tourists and market players. Implement visa facilitation policies for specific groups. Implement 3-year, 5-year, and 10-year multiple-entry visas for high-income people in emerging economies (Southeast Asian countries such as Indonesia, the Philippines, and Vietnam, Gulf countries such as Saudi Arabia and Kuwait, West Asian countries such as Turkey and Iran, South Asian countries such as India, Pakistan, and Bangladesh, and African countries such as South Africa, Egypt, Nigeria, and Ethiopia); for business tourists, learn from the "Lancang-Mekong Visa" model and provide multiple-entry visas to business personnel and their spouses and children from other regional countries with frequent economic and trade exchanges with my country, such as GCC countries; pilot visa-free policies for primary and secondary school students to study in China; implement visa simplification policies for college students and graduate students from non-visa-free countries to come to China. Improve the efficiency of visa application and customs clearance through digital technology and tools. Study and implement electronic visas and intelligent entry procedures, simplify visa application procedures, speed up visa approval, improve entry and exit efficiency, and reduce tourists' waiting time. Continue to identify and solve the bottlenecks and pain points encountered by foreign tourists during their travels, such as English electronic maps, reservations for popular scenic spots, overseas APP logins, language barriers, etc., to enhance the travel experience in China. Cooperate with domestic and foreign travel service providers to update and widely distribute multilingual versions of travel guides to China online and offline. The content should cover basic information such as visas, geographical locations, historical and cultural backgrounds, languages, currency exchange, climate conditions, safety and health, and communication networks, as well as travel information such as transportation methods, tourist resources, and accommodation and dining recommendations, and continue to improve the transparency and dissemination of travel information to China. 2. Establish and improve the national marketing and promotion system, innovate the tourism promotion system and mechanism, and establish a tourism promotion agency composed of professionals. Establish a national tourism promotion agency, and each province and city will establish a tourism destination management agency (DMO) according to their own conditions to improve the professional level of destination management and marketing work, and gradually establish a destination marketing performance evaluation mechanism. Establish a destination marketing and promotion fund to provide a source of funds for the operation of national tourism promotion. The fund can be composed of fiscal appropriations, local destination support and corporate sponsorship. Coordinate the central and local external tourism promotion work to form a synergistic force. The national tourism publicity and promotion department mainly carries out national image publicity at the brand level, determines the value concept that the brand intends to convey, and cooperates with the promotion departments of provincial and regional tourist destinations and core inbound tourist city destinations to carry out specific online and offline tourism promotion activities. Both offline promotion activities and online promotion content must echo the national tourism brand and increase the exposure of the brand logo "Nihao! China".

Study the establishment of a national inbound tourism management government platform. Establish a national tourism destination management digital platform as a central-local tourism destination management and communication integrated platform, facing the tourism destination management departments of various provinces and cities, sharing the national foreign promotion agencies' arrangements for foreign tourism promotion plans, budgets, activities, etc., and increasing cooperation with local governments.

3. Pay attention to and regularly disclose inbound tourism statistics and market survey results. At present, the inbound tourism statistics released by my country contain fewer items, are coarse-grained, and are released relatively late, which is not conducive to in-depth research and judgment of the inbound tourism market. Gradually establish a three-level tourism statistics system and disclosure system of "national-provincial/municipal-key tourist cities". At the national, provincial, municipal and key tourist city levels, break through the data barriers of various departments and disclose the tourism data of major source markets to China every month. Resume the statistics of tourist reception data (per capita consumption, average length of stay, etc.) of each province, municipality and 60 key tourist cities, and disclose them in a timely manner in the statistical yearbook and the official website of the Ministry of Culture and Tourism.

Under the guidance of the editorial board, Dr. Liu Qianqian from Shandong Normal University, Dr. Xi Yubin from Shanghai Business School and Ma Xiaofen, a postdoctoral fellow at the China Tourism Academy, participated in the writing of the report. We would like to express our gratitude to them.

We would like to thank the inbound travel service providers in the China Tourism Academy’s Inbound Tourism Case Database for their continued support for this report, providing essential first-hand data and information for the report. They are:

China Tourism Group Travel Services Co., Ltd. (China Travel Group)

CYTS International Travel Co., Ltd. (CYTS)

Ctrip.com

Expedia Consulting Services (Beijing) Co., Ltd. (Expedia)

HopeGoo, an international travel platform under Tongcheng Travel

Guilin Haina International Travel Service Co., Ltd. (China Highlights)

Nanjing HiChina Travel Network Technology Co., Ltd.

Guohua Holiday (Beijing) Travel Agency Co., Ltd. (Guohua Holiday)

Xi'an Zhuoheng International Travel Agency Co., Ltd. (Zhuoheng International Travel/Wendy Wu Tours)

Chengdu Greatway International Travel Agency Co., Ltd. (Greatway)

Beijing Olive Tree Travel Agency Co., Ltd. (Charmission)

Beijing Bishan International Travel Service Co., Ltd. (WildChina)

Shanghai UTOUR International Travel Service Co., Ltd. (UTOUR CHINA)

Shanghai Jianxi Travel Co., Ltd.

Zhejiang CYTS International Travel Co., Ltd. (Zhejiang CYTS)

Sichuan Yuanhai International Travel Agency Co., Ltd. (Yuanhai International)

Chongqing Guoli International Travel Agency Co., Ltd.

Sichuan Lost Plate Tourism Consulting Service Co., Ltd. (Lost Plate)

Beijing Jingqi Culture Communication Co., Ltd. (Jingqi Culture)

GOOD APP

GoChina.ai

Contributor | "China Inbound Tourism Development Annual Report 2024" Research Group Editor | Liu Xin Source | China Tourism Academy (Data Center of the Ministry of Culture and Tourism) Please indicate the source for reprinting